Rental Business Equipment Financing

Providing the best services for clients looking for new or used rental equipment financing to grow their business.

“It takes money to make money.”

Actually, we believe it takes ACCESS to money, to make money and ACCESS is what we’ve been providing to our customers for over forty years.

While we do finance a wide range of businesses, the majority of our major customers are in the rental business. The rental business is a different breed of cat. Rental companies are faced with a number of unique challenges and among the most critical is the constant need to finance changing inventory.

It doesn’t matter if your business is renting:

- Construction equipment

- Field services equipment

- Communications equipment

- Home health care equipment

- A/V production and editing equipment

- Party tents and tables

You have to maintain an adequate inventory that looks good and works well. To accomplish that, most rental companies need a financing resource. That’s where Charter Capital comes in.

There’s a reason that 65% of our business comes from repeat customers. Our customers enjoy the options and connections we bring to the table. And we’re confident that you will too. So contact Charter Capital to learn how we can assist you in your equipment rental finance journey.

Some of our customers...

- Are interested in the lowest rate.

- Are interested in a specific tax treatment.

- Want to avoid breaching existing lending covenants.

- Are interested in the longest term.

- Are interested in getting reimbursed for equipment they have already paid for.

- Want seasonal or other cyclical structures.

- Want to finance software.

- Want to us to give the seller a deposit before the equipment is shipped.

All of our customers want a fair deal at a fair price and no surprises.

Let rental equipment financing experts solve your unique challenges

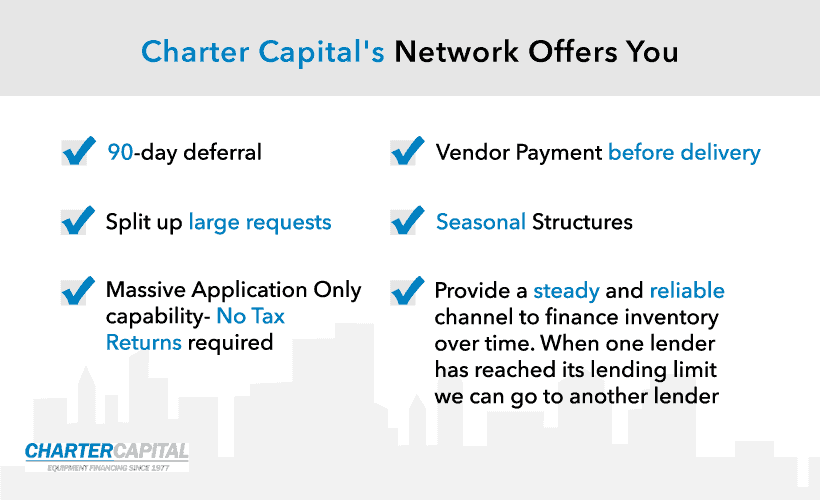

Charter Capital maintains a network of commercial lenders and banks that finance rental inventory. That network consists of 7 commercial finance companies and 10 commercial banks.

- Do you have a large financing request but don’t want to provide financials? We can do that!

- Do you need a loan this month and another next month and another the month after that? We can do that too!

- Do you need a financing source that understands the unique accounting for rental businesses? We can do that!

- Do you want to buy something at auction? We can do that!

- Do you want to buy something from a Private Party Seller? We can do that.

- Do you want to buy some equipment from a company in China? Maybe we can do that!

Rental equipment is easier to finance than you think

The common misconception is that you can only receive financing options for new equipment. This is not true if you know where to look. Our network is made up of commercial lenders whom we have been working with for over 20 years. We can provide you with various options to help grow your business. Get in touch today, and we’d be happy to discuss all the ways we can assist you with rental equipment financing.

We can finance just about anything you can rent!

Rental equipment financing with bad credit

Finding a source of equipment rental finance can be difficult with a low credit score. However, it is not impossible. Charter Capital has helped companies with bad credit receive the financing they needed. Here are some tips for securing financing when bad credit is holding you back:

To demonstrate your business’s financial health, gather statements that detail cash flow to the company and compile projections of its future financial standing. Lenders need to assess the level of risk your business poses before deciding whether or not to extend a loan. Having a track record of steady, positive cash flows is one way to mitigate the effects of bad credit in lenders’ eyes.

Additionally, explore a range of options before settling on a specific lender. You should not feel tied down to one company, even when options are limited. In reality, some reputable lenders may help you despite your bad credit score. With Charter Capital at your side, you’ll have access to multiple options and be able to find sources of equipment rental finance that you might not otherwise have known about.

A word of warning— be on alert for predatory lenders. It’s crucial to examine the policies and terms lenders offer. If the lender charges upfront fees to “process and ensure” your loan, this is a red flag signaling the company is likely an unreliable source. Learn about common fees associated with rental equipment loans, so you know what to expect. Charter Capital connects you with trusted lenders and will counsel you on the benefits and drawbacks of each proposal you consider.